Newsletter – February 2022

Click here to view and download the newsletter in its original format.

Spring is here, COVID is gone and there is an air of optimism going around. Now if we can just beat inflation… We’re into February, and hopefully your year has started well. Here’s some pointers to keep you on the right track.

EWSS – Almost Gone!

EWSS: 1 February 2022 – 31 May 2022. The EWSS is to be phased out over the next few months. The reduced rate of employers’ PRSI of 0.5% is finished for all businesses on the 28th February 2022.

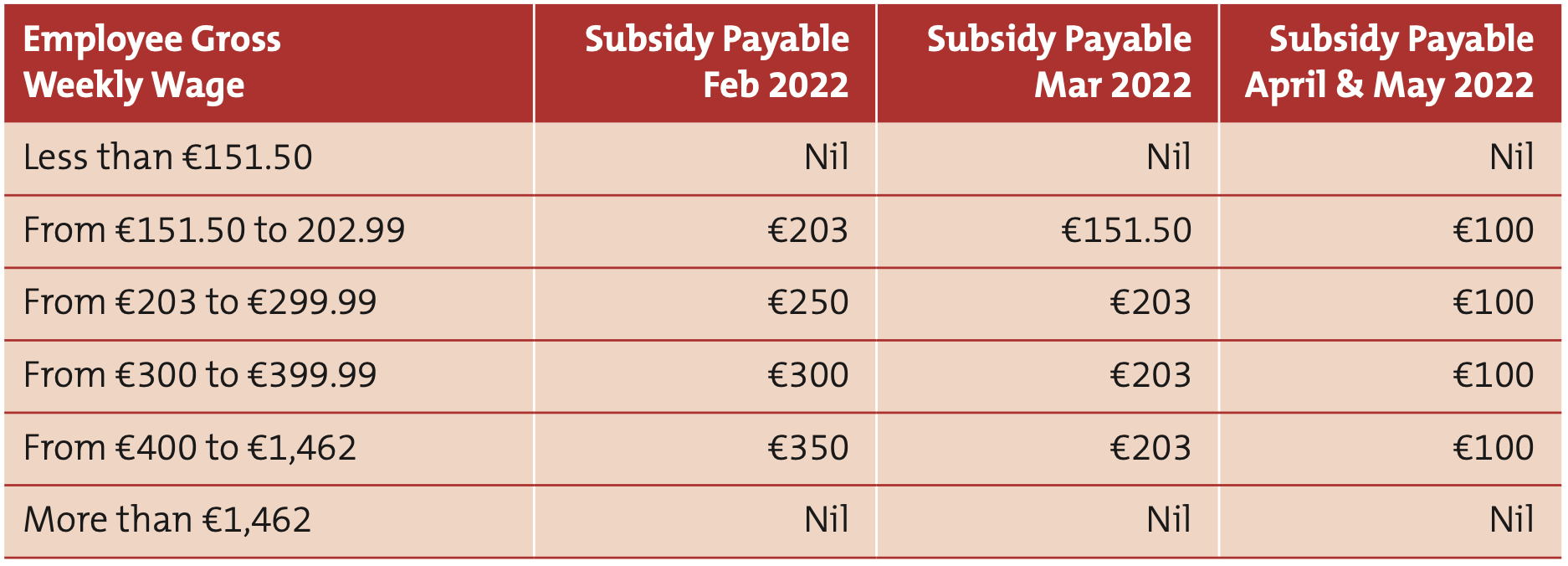

There are 2 different categories: One for businesses that were impacted by the restrictions in place between 20.12.2021 and 22.01.2022 – e.g. gyms, restaurants, venues, bars etc. The second category is for businesses that weren’t impacted by the most recent restrictions, this will be the case for most businesses. Here are the rates and dates for businesses impacted by the restrictions in place between 20.12.2021 and 22.01.2022:

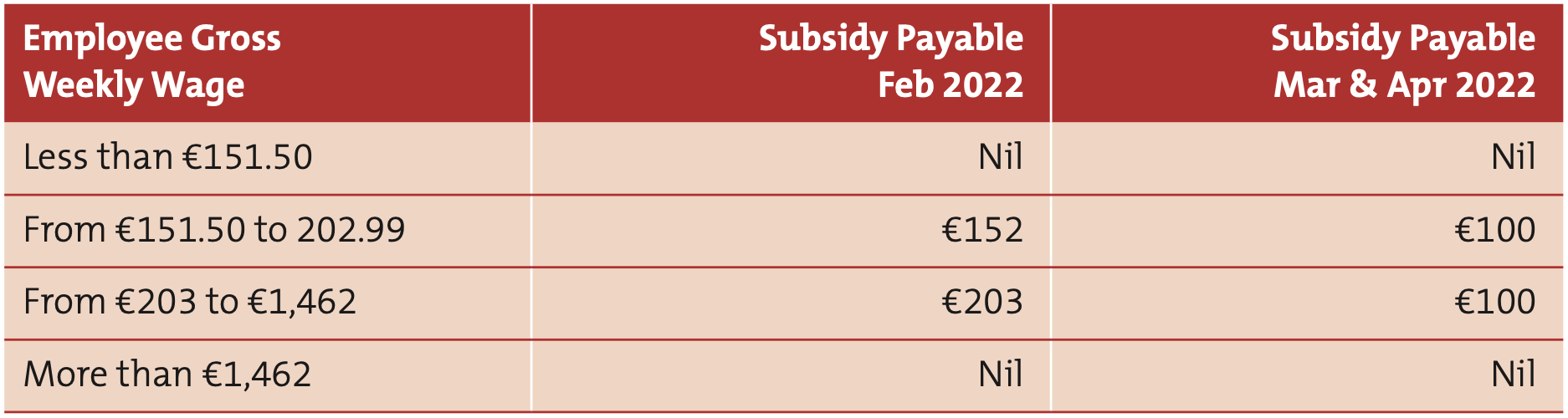

Rates and dates for businesses that were not impacted by the recent restrictions:

Introduction of the Statutory Sick Pay Scheme

Starting from 2022 employers will be obliged to pay 3 days sick leave @ 70% of an employee’s wages up to a maximum of €110 per day.

This will increase to 5 days in 2023. In 2024 it will be 7 days, rising to 10 days in 2025.

LEO Voucher for Website and SEO Marketing

This scheme was first launched back in 2020 and it is still available. You may be entitled to a second round of funding even if you have already received the grant.

The Trading Online Voucher scheme is funded by the Department of Enterprise, Trade and Employment (DETE) and is aimed at established micro-businesses, including sole traders, with little or no trading online capability, operating in sectors where the market has not already compelled them to develop this capability.

The scheme offers a grant of up to €2,500 (subject to matched funding) to help micro-enterprises (10 employees or less) to develop their e-commerce capability, and in turn reap the positive enterprise impacts of trading online.

To apply, log on to your Local Enterprise Office website, search for “Trading Online Voucher Scheme”. Have a read of what you will need (you may need some input from us), gather these, and then click on the “Apply Now” big button.

Never, Ever, Ever Agree a Net Wage

Many people still refer to a net pay when negotiating their employment. So it’s fine to agree the net wage at the start and translate that into a gross wage for the contract, but remember to commit to the equivalent gross wage – do not commit to the net.

The reason for this is that a person’s tax credits can change due to no fault of yours, and this may then lead to an increased cost to you.

The worst case we have encountered is an employee who transferred all their tax credits to their wife, and reduced their standard rate cut off. This led to a €7,000 gross increase to the employer – they had foolishly written a net pay figure in the contract.

A New Way of Bookkeeping

Here in John O’Callaghan Ltd Accounting, we are always trying to find ways to help make our client’s life easier. During 2021 we began to use two different Apps: Xero and Dext. Both are very easy to set up and use, and most importantly free up your time.

Sales Invoices – Xero

Xero is an app where you can create and send your sales invoices directly to your customers from your phone – when you’re ready to invoice simply take out your phone and create the sales invoice on the spot and email it directly to the customer. It also of course works on your pc too. Xero keeps track of all invoices issued and can automatically issue reminders and statements on your behalf with no additional work. It can also be integrated with a payment system like Stripe for customers to pay you easily.

Purchases Invoices & Receipts – Dext

Dext is an app to help you forward your purchases invoices and receipts in a much easier, quicker and more prompt manner. How it works is: we send you an invite to Dext, you download the App, and once downloaded, you simply take a photo with your phone of all those expenses that you store in a shoe box to bring to us when dropping in your VAT data.

For example fuel and small till receipts – you simply take a photo of that Diesel receipt from the Garage, press submit and that is it. You can throw away the receipt and forget about it – it will now be uploaded to our system. For larger purchase invoices that you receive by e-mail from your suppliers we will also give you a Dext email address that you can forward your invoices directly to – no more printing them out or physically delivering them to us.

Advantages

- You don’t have to store or root for missing cash receipts, as they will all be on your accounting package.

- As we receive data in a more timely manner, we will be able to answer your queries more promptly.

- Your vat return can be completed earlier, as we will have received the data earlier.

- You will not have the inconvenience of having to call to the office to drop off your data.

- No more storing folders of data for 7 years, we will have it all uploaded on your accountancy package.

- Revenue prefer and accept this electronic method of storage.

- Zero cost to you! We will be in touch with you over the next few weeks to discuss how this can work for you.