Newsletter – December 2021

Click here to view and download the newsletter in its original format.

Welcome to our December newsletter. I hope both you personally and your business are all ready for Christmas, and that it will finish the year off well for everyone. I’d like to thank our customers for your continued support during 2021, and I look forward to working with you all next year, and hopefully it will be a better one.

December Check List

Here’s a little reminder of things you may need to do before the year end:

- Use the €500 once per annum tax-free vouchers / pre-paid credit cards.

- Check if you have used all of your standard rate cut-off threshold and, if not, pay yourself a bonus to utilise any available capacity.

- If you have made a profit in 2021, remember to make your pension contribution from the company before 31st December in order to qualify for corporation tax relief in 2021.

- Stock take – if your year-end is 31st December, and your business has stock of any description, remember to schedule a stock-take. Plan this either the last day you break up for Christmas, or the very first day back in 2022.

- Remember to send us in your weekly waged employee’s hours for week ending 31st December as soon as you can so that they will be paid the correct amount the following week.

- For employees with company cars, ask them to confirm the odometer reading on 31st December – this may help reduce any benefit-in-kind they pay.

- For those still availing of the EWSS, send us your sales figures for December as soon as you can – they must be submitted by 14th January in order to receive payment in January.

- Make use of the €3,000 small gift exemption annual allowance (this helps reduce inheritance tax liability for the beneficiaries of your estate) – sorry to be morbid.

- Order your electric car for 2022.

- Turn off the lights, set the alarm, go home and relax and enjoy Christmas.

EWSS extension

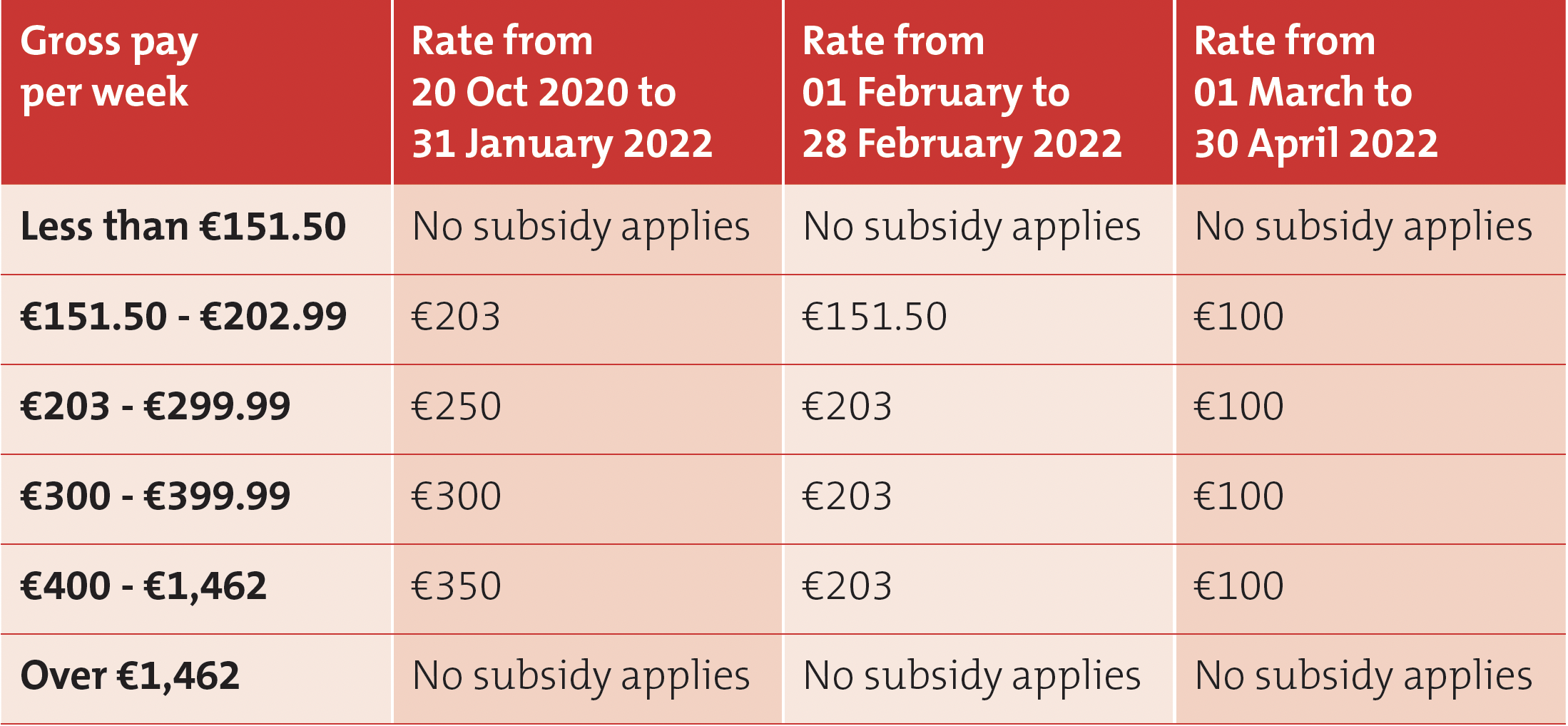

As a result of the increasing COVID numbers, the Government has decided to re-instate the EWSS enhanced rates for the months of December 2021 and January 2022, and to extend the scheme until April 2022. This has the following positive effect. The following rates apply:

Remember to send us in your sales asap so that you may continue to avail of this scheme.

Tax liability arising from TWSS income in 2020

Sadly we need to remind you that Revenue will start to collect this tax from January 2022. To reduce the impact, Revenue will collect the tax arising as a result of receiving the TWSS interest-free by reducing tax credits over 4 years. This reduction will start in January 2022. For example, if a person has a liability of €600, their net wages will be reduced by €12.50 per month.

Be prepared for emails and phone calls from your staff moaning about this – it’s not your problem, and beyond your control. Remind them that they did not suffer any net pay reduction in 2020 as a result of receiving the TWSS, but that Revenue omitted to tell people in advance that this may be taxable – they did confirm it after it had been introduced.

Looking forward to 2022… failing to plan, planning to fail

At this time of year, we work closely with many of our clients to put a budget in place for next year. We have found that looking at the past can help predict the future, but that by also setting budgets and putting it down on paper helps focus the mind. Studies have shown people who have a written plan are more likely to achieve their goals than those who don’t have a written plan.

It doesn’t have to take days, any effort is better than none. If you would like to implement budgets for next year, please contact us and we can schedule it.

Personal Finance Corner

Save serious money on your mortgage

Since the advent of COVID, many of our clients have spent less money on a monthly basis. A good application of this would be to accelerate repayment of your mortgage. In the case of a €400,000, 25-year mortgage at 3% interest, paying an additional €100 per month off will save a whopping €13,745 off the interest, and reduce the term by 20 months. If you haven’t done this already, make it your new year’s resolution.

Thanks to Dave Curry of Nova Mortgages for these figures. Dave may be contacted at [email protected] if you need any advice on mortgages.